Life Insurance Term Vs Whole

Life Insurance Term Vs Whole. Life insurance for ages 18 to 85. As long as the policyholder.

The benefits of lifetime coverage, and over time the guaranteed. Simply answer a few questions online to see multiple options for term life coverage While common, these policy options.

The Costs Of Either Plan Vary Depending On Age Group, Gender, And Medical History.

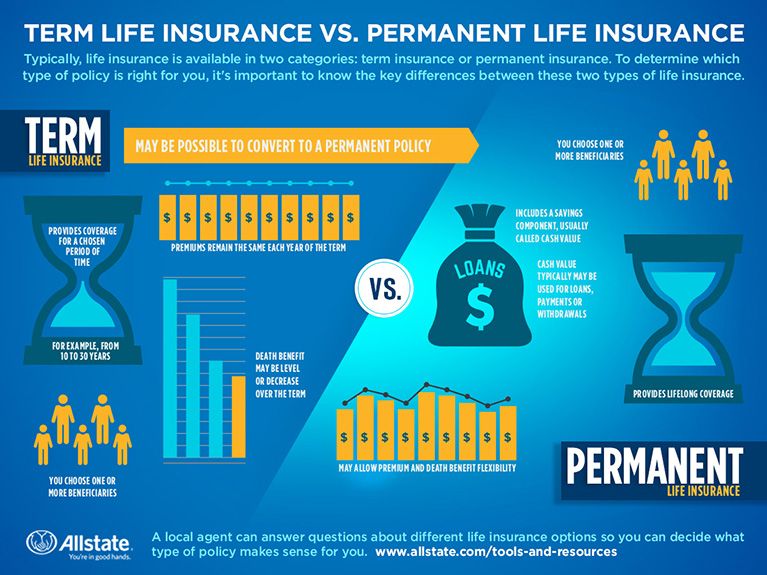

Whole life insurance is the time the policy is in effect. Permanent life insurance or whole life insurance is entirely different from term insurance in two fundamental ways. And here’s the key difference between whole life vs.

Whole Life Insurance Lasts Your Entire.

Term life plans are much more affordable than whole life. One of the main differences between whole and term life insurance is the cost. The benefits of lifetime coverage, and over time the guaranteed.

Whole Life Insurance Has A Higher Initial Premium Than An Equal Amount Of Term Insurance, But Don't Confuse Cost With Value.

Whole life insurance policy that accrues cash value. Prepare and find a policy that aligns with your needs with new york life Shop, compare and apply for the best plan today

Firstly, It Never Expires As Long As The Policyholder Pays The Premium.

Ad exclusively for aarp members. Ad helpful information to decide what insurance is right for you. Find affordable whole life policies.

This Is Because The Term Life Policy Has No Cash Value.

It covers you for a set period of time and pays out if you die during the term. Term and whole life insurance. Ad life insurance you can afford.

0 Response to "Life Insurance Term Vs Whole"

Post a Comment